#Micro cap stocks 2021 free#

Over the next several years, I expect the company to grow free cash flow significantly as its private equity business expands. P10 Holdings (PX) is an under-the-radar micro-cap operating in an extremely stable and profitable industry (private equity). 3 Micro-Cap Stocks to Buy Now Micro-Cap Stock to Buy: P10 Holdings, Inc. Let’s look at three micro-cap stocks that are better bets than BONZ. In fact, Bonanza has subsequently given back that 1,000% gain and is now down 16% on the year. Because it had none of those characteristics, avoiding Bonanza was the right move at the time. When evaluating micro-caps, I’m looking for companies with 1) substantial growth, 2) conservative balance sheets, and 3) inexpensive valuations. This means that management has pumped up its stock price via promotional press releases and then sold additional stock, diluting existing shareholders. Third, the number of shares outstanding had grown exponentially. Despite touting “great” mining results, the company had failed to generate any revenue in its entire life (as far as I can tell).

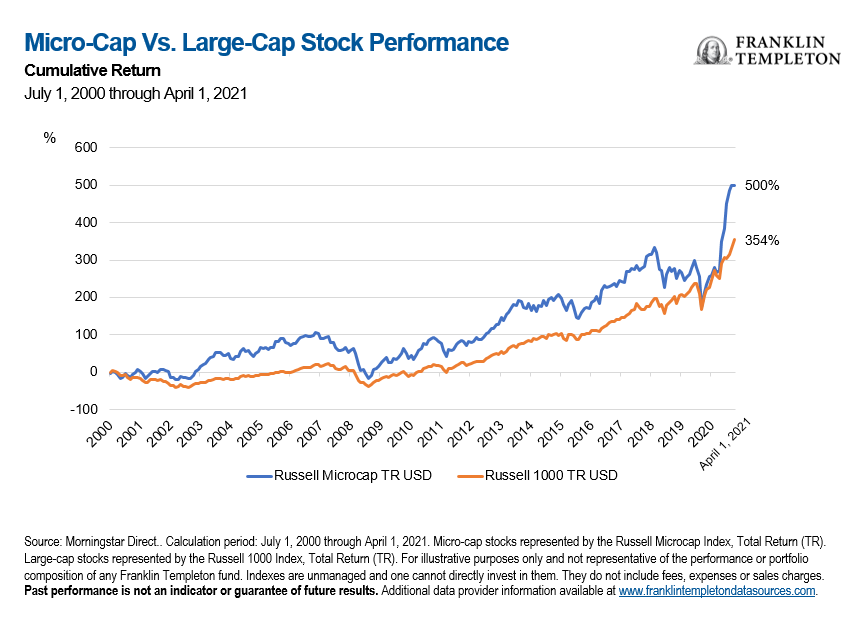

Second, the company had poor financial trends. It is a red flag when a company makes an acquisition in an industry (especially a “hot” industry) in which it has no expertise. Luckily, it didn’t take me long to conclude this was a name to avoid.įirst, the company – up until the announcement – had been a gold mining company. I decided to dig in to see what all the hype was about. Get My ReportĪs a result of the acquisition announcement, Bonanza’s stock surged up over 1,000%. If we look at the Sharpe ratio in the second chart, we can see that both of the small-cap indexes would have offered better risk-adjusted returns over the whole period.Find out which stocks you should buy this month to make money in this volatile market. Generally speaking, the greater the value of the Sharpe ratio, the more attractive the risk-adjusted return.

The reason to subtract the risk-free rate from the average return is to better isolate the return associated with higher-risk investment decisions. This ratio shows the average return earned in excess of the risk-free rate per unit of volatility or total risk. One way of combining the risk and return perspectives is to look at the Sharpe ratio. Volatility for the MSCI Emerging Markets Index remained closer to the volatility of the MSCI Emerging Markets Small Cap Index. For most of the last 20 years, the MSCI World Small Cap Index had a five-year historical volatility (annualized) that was higher than that of the MSCI World Index (on average 2.5%). We can see an impact of last year’s increase in volatility, especially in small caps, but it was modest compared to the impact during the 2008 global financial crisis and the recession that followed. The first chart shows rolling historical volatility for both developed- and emerging-market indexes and their small-cap equivalents. Market volatility did greatly increase last year, as uncertainty about the impact of the pandemic rose, but we have seen it decline rapidly and substantially, as government support worldwide and the vaccine rollout has allowed for a more constructive outlook. To complement that analysis, we look at total risk or volatility. We recently looked at small caps through the lens of historical performance during economic recovery.

0 kommentar(er)

0 kommentar(er)